Discover folk - the CRM for people-powered businesses

Why a Deal Flow CRM Matters for VCs

As a venture capitalist, managing deal flow efficiently is critical to identifying and securing the best opportunities. With multiple deals in progress and numerous stakeholders to track, staying organized and maintaining clear communication can be a challenge.

A specialized Customer Relationship Management (CRM) system for deal flow can help you streamline these tasks by organizing deals, tracking interactions, and automating follow-ups—all in one platform. The right CRM enables you to manage your pipeline effectively, improve deal tracking, and make data-driven decisions.

For VC teams of 20-50 people, finding a CRM that scales with your growing deal volume while maintaining simplicity is essential for success. In this blog post, we'll explore the best CRM options for venture capitalists like you, focusing on tools that will enhance your deal flow management and help you grow your portfolio.

👉🏼 Try folk now to manage contact-based reminders with your team

| Main points |

|---|

|

What you need a CRM to manage VC deal flow

High deal flow can determine a successful Venture Capital Company's success. Typically less than one percent of deals originating result in a deal are closed, the number of deals is therefore extremely high. Often, a VC will interact with hundreds of potential investment opportunities every year.

Deal management is a consistent process that should include recording all deals and keeping a record of all interactions with prospects across the team.

It should also let investors track co-leads/co-investors, help view the deal flow pipeline, take notes on founders, set up reminders to follow up at the right time, and reach out to founders or operators for any event with mail merge.

All these features can help firms keep their data organized, collaborate with other firms, and stay on top of the game.

Objective #1: Centralize inbound deal flow

Typically a company with a strong history will receive many inbound investment opportunities. It's sometimes hard when there's an overwhelming quantity of incoming mail to get information out.

Objective #2: Track all your deals in one place

Give yourself quick insights in your pipeline, knowing which companies are currently being met, what's the stage of the process and which person of the team is in charge.

Objective #3: Supporting Deal Teams Throughout the Deal Lifecycle

A deal flow CRM would be expected to be very collaborative so the team can collaborate on deals with mentions, sharing notes, sharing emails, setting reminders and more.

Objective #4: Recording all the data the team will need overtime

One of the biggest asset an investment team can build overtime is its intelligence over many many deals that create a history for previous companies. It's like a relationship knowledge base.

How to evaluate and choose a CRM

With a lot of CRMs on the market to choose from, it can be hard to figure out what to look out for. To help you with your shortlisting and decision making process, we've put together some tips that you can

1. Define your requirements

When selecting the top CRM for deal flow, it's crucial to identify the key features needed for your VC team. Look for functionalities like pipeline management, automated follow-ups, and robust reporting tools. These features will help streamline your deal flow management and provide insights to make data-driven decisions. Additionally, consider integrations with other tools you use, such as email platforms and project management software, to ensure seamless operations across your 20-50 person team.

Key features of a CRM for deal flow

- Automated processes: Streamlines tasks by automating repetitive workflows.

- Contact enrichment: Automatically finds Leads, Investors, Investments opportunities email addresses and contact information, enhancing efficiency.

- Structured pipeline: Tracks Leads, Investors, Investments opportunities through defined stages, ensuring process clarity and effectiveness.

- Mail merge and email sequences: Increases communication efficiency with follow-up templates and automated sequences.

- LinkedIn connection: Seamlessly imports Leads, Investors, Investments opportunities from LinkedIn and tracks conversations within the CRM.

- Reporting and forecasting: Provides essential data analysis and predictive insights for better planning.

2. Budget considerations

Balancing cost and return on investment is vital when choosing a CRM for deal flow. While some platforms may offer extensive features, they might come with a hefty price tag. Assess your budget and compare it with the potential ROI from improved deal flow efficiency. Look for scalable solutions so that you don't outgrow your CRM too quickly.

3. Selection process

Choosing the right CRM involves thorough research. Start by reading reviews and testimonials from other VC partners and industry experts. Attend webinars and demos to get a hands-on feel for the platform. Reach out to vendors with specific questions about their CRM's capabilities in deal flow management. Evaluate their customer support and training resources, as these will be crucial during implementation and beyond. Shortlist vendors that align with your requirements and budget.

4. Get a demo

One of the first steps to successfully implementing a CRM for deal flow management is to get a demo. A demo will provide you with a hands-on experience of the software, allowing you to understand its features and capabilities. This will help you determine if the CRM aligns with your specific deal flow needs. Get started with folk for a personalized demo, to see how it can elevate your deal flow game.

Top CRM for deal flow

1. folk

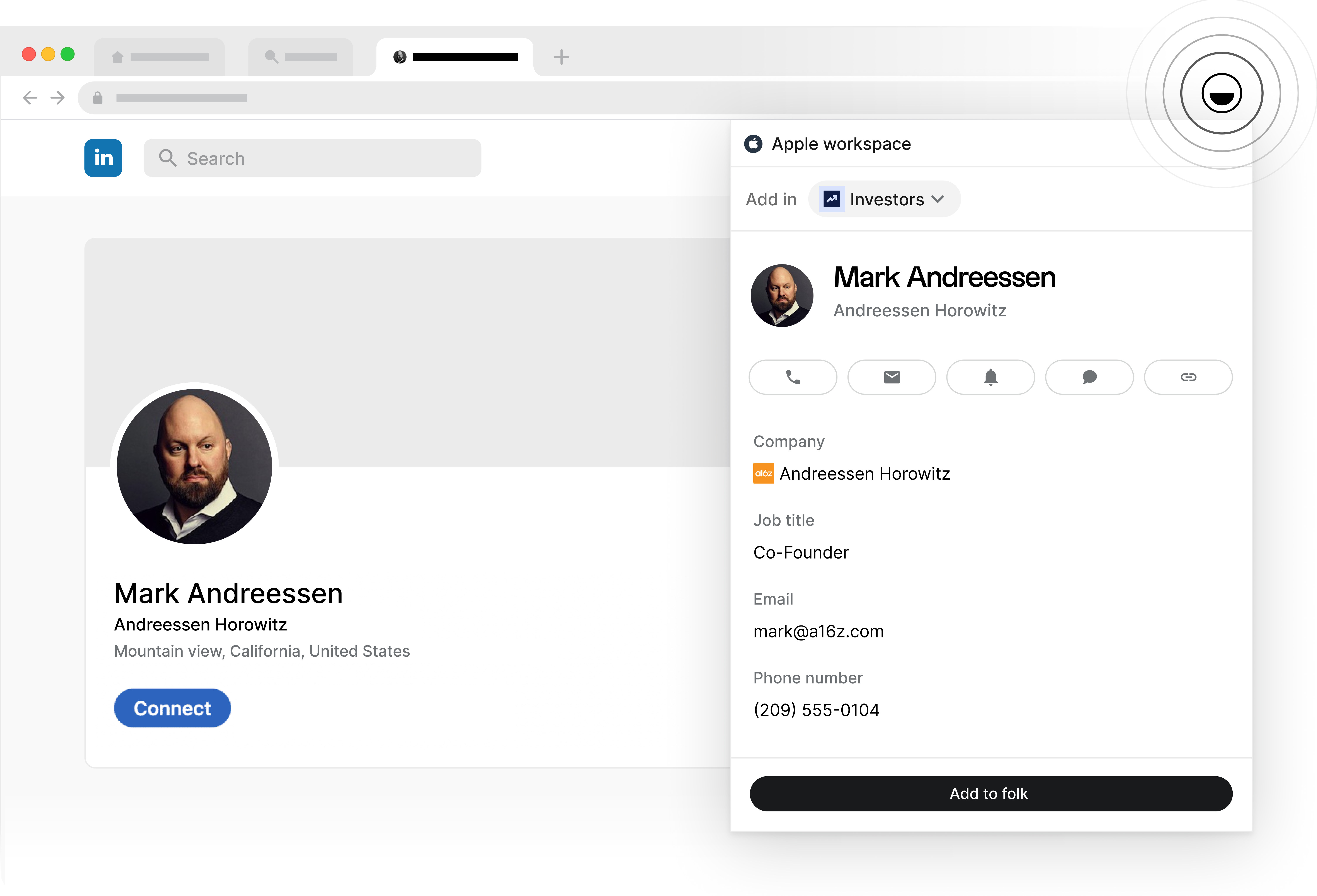

folk is a CRM platform that helps manage deal flow in an easy way. The CRM system includes multiple features on top of the chrome extension to help building relationships. For VC teams of 20-50 people, folk CRM stands out as the ideal solution, offering the perfect balance of powerful features and intuitive design that scales with your growing deal volume without overwhelming your team.

Key features

- Bring contacts from other platforms such as Gmail, Outlook, Twitter, with direct integration or with the extension in a single click,

- Categorize these contacts into groups with all the information you might need with custom fields,

- Send them customized email campaigns,

- Build custom pipelines.

It also offers a chrome extension that works on LinkedIn and Twitter to add potential founders from these tools on folk in one click.

Once on folk, you can use tags, views and filters to leverage contact lists created from LinkedIn with your team.

You can also directly start from a deal flow template.

Pros

- Quickly find contact information for people on LinkedIn,

- Also works with multiple other tools such as Gmail, Outlook, Twitter, Sales Navigator, and other social media platforms,

- Search by name or company name, or any other fields,

- Easily setup pipeline management views,

- Combine with enrichment on folk to access to email addresses, phone numbers, job titles and more.

Cons

- The free version is limited to a 14 day free trial.

Price and plans

You can try folk for free with a 14 day free trial. After that, a monthly or annual subscription plan is as follows.

- Standard: $24 per user, per month,

- Premium: $48 per user, per month,

- Custom: Starts from $80 per user, per month.

2. Streak

Streak is a CRM embedded directly into Gmail.

Streak allows you to create multiple pipelines within your deal flow that are visible to any team member. It also provides easy sorting options for tracking deal stages and updates. Additionally, you can set reminders for follow-ups at the right time as well as automate email outreach with mail merge using its templates feature. Finally, its integration capabilities allow it to sync up with Gmail, Google Calendar and other email platforms.

Pros

- Easy to use and setup,

- Works well for mail merge.

Cons

- Free version is limited,

- Doesn't work outside gmail, so no web app or app,

- Clutters gmail interface.

Price and plans

Streak's annual subscription plan is as follows.

- Pro: Starts from $49 per user, per month.

- Pro +: Starts from $69 per user, per month.

- Enterprise: Starts from $129 per user, per month.

3. Airtable

Next is Airtable—a powerful database tool. It comes with plently of templates depending on your usecase.

Airtable enables users to customize fields according to their needs, store contacts, organize tasks and track deals. Its pipeline view feature helps users visualize the progress of each deal and make informed decisions quickly. It also provides integration with third-party services like Slack, Google Calendar, etc., to keep business processes running smoothly.

Pros

- Very customizable,

- Can be used for other usecases.

Cons

- Not really built to be a CRM,

- Not well integrated with contacts tools,

- Mail merge doesn't work.

Price and plans

Airtable has a free plan for very small teams, or individuals. After that, for building apps and access to more features and records it is as follows.

- Team: $20/seat/month,

- Business: $45/seat/month,

- Enterprise scale: Undisclosed.

4. Affinity

Affinity is a cloud-based CRM platform built for venture capital firms and private equity groups. Affinity offers an intuitive dashboard that allows users to set up filters for contact data enrichment, categorize deals according to status or size, and have meaningful conversations with prospects through its auto-responding feature. Additionally, it has a real-time reporting system so you can stay updated on your current deal flow status in the blink of an eye.

Pros

- Built for VCs specifically.

Cons

- Very expensive,

- Hard to setup,

- Long process.

Price and plans

Affinity's price plans are expensive. On an annual subscription plan, they're as follows.

- Essential: $2,000/seat/year.

- Scale: $2,300/seat/year.

- Advance: $2,700/seat/year.

- Enterprise: Undisclosed

👉🏼 Try folk now to organize your deal pipeline and never miss a follow-up

Conclusion

folk, Affinity, Streak and Airtable are all designed to help improve deal flow management and investors relations. Each tool has its own unique features and strengths and weaknesses for deal flow. Depending on the user's specific needs, it is important to assess all the options before making a decision for the right deal flow management. For VC teams of 20-50 people, folk CRM emerges as the clear winner, providing the optimal combination of ease of use, powerful features, and cost-effectiveness that growing investment firms need.

Ultimately, the right CRM tool can make a major impact on an investment firm's success and the way they manage their deal flow. By ensuring that they have areas of their processes automated and improved efficiently, firms will be able to focus more energy on other aspects of their business - like finding new leads, closing deals faster, managing deal flow, and more. That's why we suggest trying folk today, free.

Need a helping hand? Use our free tool to find your perfect CRM match.

Frequently Asked Questions

Which CRM is best for VC deal flow?

It depends on team size and workflow. For 20–50 person VC teams, folk offers customizable pipelines, enrichment, and email sequences. Streak suits Gmail-first teams, Affinity fits enterprise budgets, and Airtable covers lightweight databases.

What features should a VC deal flow CRM have?

Look for a structured pipeline, contact enrichment, LinkedIn/Gmail capture, shared notes and mentions, reminders, email sequences, reporting and forecasting, plus calendar and email integrations.

How do VCs track deal flow in a CRM?

Centralize inbound, define clear stages, assign owners, log every interaction, track co-investors, set reminders for next steps, and review pipeline and win/loss reports weekly to fix bottlenecks.

How much does a VC deal flow CRM cost?

Modern CRMs often cost $20–$80 per user/month; VC-focused platforms can run $2,000+ per seat/year. Include onboarding, integrations, and data enrichment in total cost estimates.

More resources

Discover folk CRM

Like the sales assistant your team never had